How strong is your adulting game? Let’s put it to the test.

How much does it really cost to adult? In a recent video with popular YT channel Rec.Create, we sat down to test the adulting math of four Pinoys in different stages of planning their own finances and futures.

In this article:

- Key takeaway: You're in charge now

- Living on your own

- Wants vs. needs

- Top 3 adulting priorities

- When it comes to healthcare

- Let’s talk about retirement

- Actions you can take

Watch the video

Spend a few minutes with Lorraine (multimedia artist), Jessa (virtual assistant), Martin (working in finance), and Benz (seafarer and father) and see what you can learn from their super-relatable adulting experiences.

Key takeaway: Totoo na ‘to. You're in charge now.

One of the biggest wake-up calls in adulting? Bills don’t pay themselves. No one reminds you to do anything, and you get to make big decisions like taking on debt and getting your own place.

This is partly why many Filipinos of “adulting” age feel financial pressure. In a 2023 survey, global consultancy Deloitte found that 65% of Pinoy Gen Zs had taken on a second job or part-time work on top of full-time. More concerningly, over half (59%) admitted living paycheck to paycheck.[1] So how much does adulting really cost?

Adulting means living on your own

For many, adulting means living independently. Today’s young adults are moving away from the traditional extended family living common in Filipino and Asian cultures. According to a 2025 report by Dentsu Creative, young adults (aged 22-35) are highly motivated to buy a house and move out of their parents' homes within six months.[2]

Buying Property

Given the high cost of renting, many young adults focus on buying their own property. You can expect to pay 6% to 8% interest for a 5-year term.

Renting in Metro Manila

Philippine government figures from 2020 show that 10.8% of Filipinos rent their homes[10], with the highest percentage in Metro Manila. How much does it cost, and how can you plan it?

- Budgeting rent - Financial experts often recommend spending around 30% of your monthly gross income on rent as a good starting point. [5]This rule helps keep your budget balanced by preventing overspending on housing, making it easier to save for emergencies and other financial goals. However, it's not a one-size-fits-all solution, so you may need to adjust this figure based on your personal financial situation, goals, location, and cost of living.

Alternatively, you can use the 50/30/20 rule to set your rent budget. This rule suggests allocating 50% of your income to essential expenses like rent, utilities, and groceries, 30% to discretionary spending such as dining out and entertainment, and 20% to savings and debt repayment. This approach considers your overall budget and individual needs to determine how much rent you can afford. [5] As of late 2024, rent in Metro Manila ranged from PHP 1,050 to PHP 1,200 per sqm, averaging PHP 20,000 to PHP 30,000 for a one-bedroom in areas like Makati or BGC.[4] - Living expenses - Besides rent, budget for utilities like internet, food, laundry, and daily transport. Food and transport costs are significant in our country. Remember, balanced healthy eating now is far cheaper than poor health.

So, it is prudent to decide if an expense is essential or not.

Adulting means separating wants vs. needs

One of the biggest wake-up calls in adulting is managing your spending. Many young adults today are comfortable with credit cards, making up 33% of first-time cardholders in 2023, according to TransUnion. With mobile wallets, digital banks, and online shopping, it's easy to splurge.[9]

When it comes to credit cards, debt isn't inherently bad, as long as you use it intentionally and responsibly. Finding your balance ensures you don't just live in the moment but also set yourself up for long-term financial stability. Before you splurge, ask yourself: is this a need or a want?

Non-financial boundaries are equally important. Adulting means defining yourself as your own person. Sharing money with family remains a core Filipino value, even when we move out. However, new circumstances mean new terms. Learning to stand up for yourself is an adulting skill that will be incredibly useful in the future.[6]

Top 3 priorities for adulting

Ask any adult what they wish they had learned earlier, and chances are they’ll say, “How to handle money better.” Budgeting, saving, and investing are what you build over time to make sure you’ll have more than enough.

Start by understanding your monthly and yearly income and expenses and be completely brutal. Treat building your emergency fund as an essential expense. How much should you save? While estimates vary, aiming for six months' worth of living expenses is a safe and realistic goal.

According to guests, these are their top 3 adulting priorities:

- Savings - Prepare for the unforeseeable future. Most of us have salary accounts but consider separate bank accounts for your savings and emergency fund.

- Health – At age 21, student or not, you can no longer be registered as your parent’s Philhealth dependent. That’s our cue to get our own and start building our long-term health plan. Prioritize health insurance, company or self-funded HMO and other advance efforts.

- Happiness - Allow yourself the “breather” of experiences that will continue to make you happy and secure for the long term.

Allocate money for insurance, health, and retirement. These might seem far off, especially if you're single, but you'll be surprised how quickly time flies. Among Filipinos, life insurance is the most popular choice. No matter which plans you choose, buying insurance gives you control over your future and your family's future.

As our guest Martin wisely said, “it’s more about buying peace of mind” – knowing you won't have to worry about life's surprises later on.

Speaking of healthcare

Global risk managers expect healthcare expenses in the Philippines to increase by 18.3% this year, the second highest figure for Southeast Asia. [8] This is consistent with our country’s trend of double-digit medical cost.[7]

On the plus side, PhilHealth coverage has been improving, and employees are being given HMO cards. These are a big help, but their coverage may simply not be enough for you. The good news, these “adulting” years are the best time to get health insurance, because you can get coverage at a very affordable rate.

Now, let’s talk about retirement

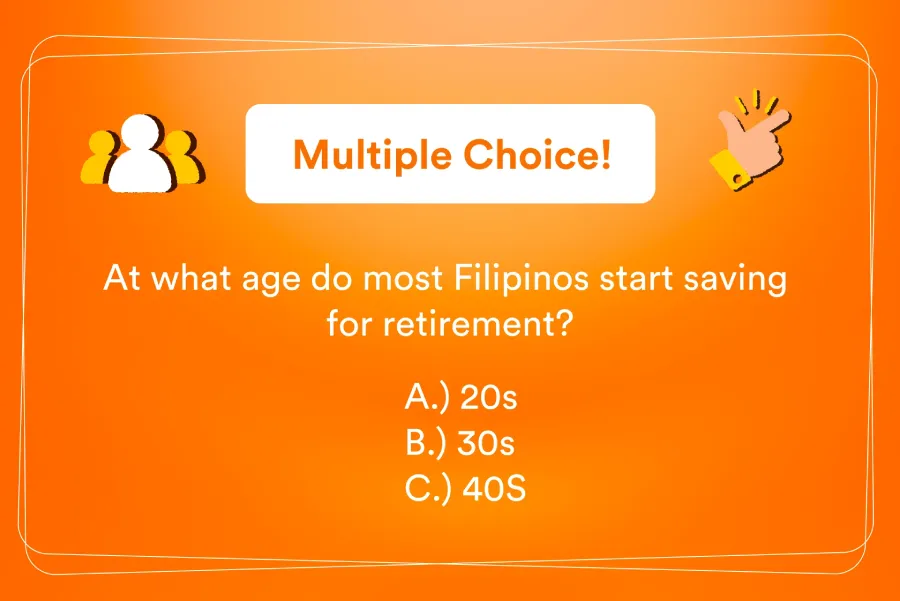

Interestingly, most Filipinos start saving for it at age 40. With the current retirement age at 60 and life expectancy at 67 for men and 74 for women[3], that leaves us with 10-14 years of living expenses to cover, plus inevitable healthcare costs.

But we can make smarter choices. As one guest wisely said, “Put money in financial products specifically suited for retirement.” These can include investment funds or accounts like Pag-Ibig MP2, investment-linked insurance, and retirement-oriented savings accounts like the Personal Equity Retirement Account (PERA), the Filipino counterpart of the 401k or IRA in the United States.

Starting our savings and investments early gives our money decades to grow while we continue working. This extended timeline allows us to learn the ins and outs of investing, develop our own style, and understand our risk tolerance. We can also afford to make a few mistakes along the way, both financially and otherwise. Investment-linked insurance can be a good option for both life protection and building an investment portfolio.

Actions you can take

“Hopefully we get to realize na hindi lang tayo basta living day to day. We have to start protecting our future and building for it. It’s hard but it’s worth it down the line”, said Martin.

If you're ready to take the next step but need help getting started, FWD’ has your back. From life and health protection that fits your lifestyle to investment-linked insurance options that grow with you, FWD is here to help. Because making the right choices today means a more secure tomorrow. Future you is counting on you to make the right choices now. #Youllthankyoulater

Sources:

[1] Deloitte Gen Z and Millennial Survey, Deloitte.com, 2023

[2] Fragment Forward: Dentsu Creative on the future of intergenerational living and collectivism in the Philippines,” adobo Magazine Online, March 2025

[3] Philippines: Life expectancy at birth from 2012 to 2022, by gender, Statista, Nov 2024

[4] How much is the average rent for an apartment?” C2M3.com, May 2024

[5] Calculating Your Rent Budget: A Step-by-Step Guide, Business Insider

[6] Motivating Filipino Generation Z employees at work: enablers and outcomes’, Ateneo de Manila University, 2024

[7] Filipinos face retirement gaps as costs and lifespans rise”, Insurance Business Asia, Feb. 2025

[8] Global Medical Trends Survey, WTW, January 2025

[9] Philippines’ Robust Credit Card Market Poised for Further Growth Driven by Greater Financial Inclusion, TransUnion, July 2024

[10]2.86 million households rent their homes”, manilastandard.net, August 2023

We use cookies to give the best possible web experience. By continuing to use our website we assume you accept how we use cookies and your data. This in keeping with our Privacy Policy. | NPC Seal of Registration 2024